Sonoma County Housing Market Update & Predictions For 2024: What’s Happening With Rates, Prices & Inventory?

Are you wondering what’s going on with Sonoma County real estate this year? Our market is always evolving, so it’s important to stay up-to-date if you’re eager to achieve your real estate goals. From declining sales to interest rates and inflation, let’s take a look at the real estate trends that are shaping our market and what’s to come the rest of the year.

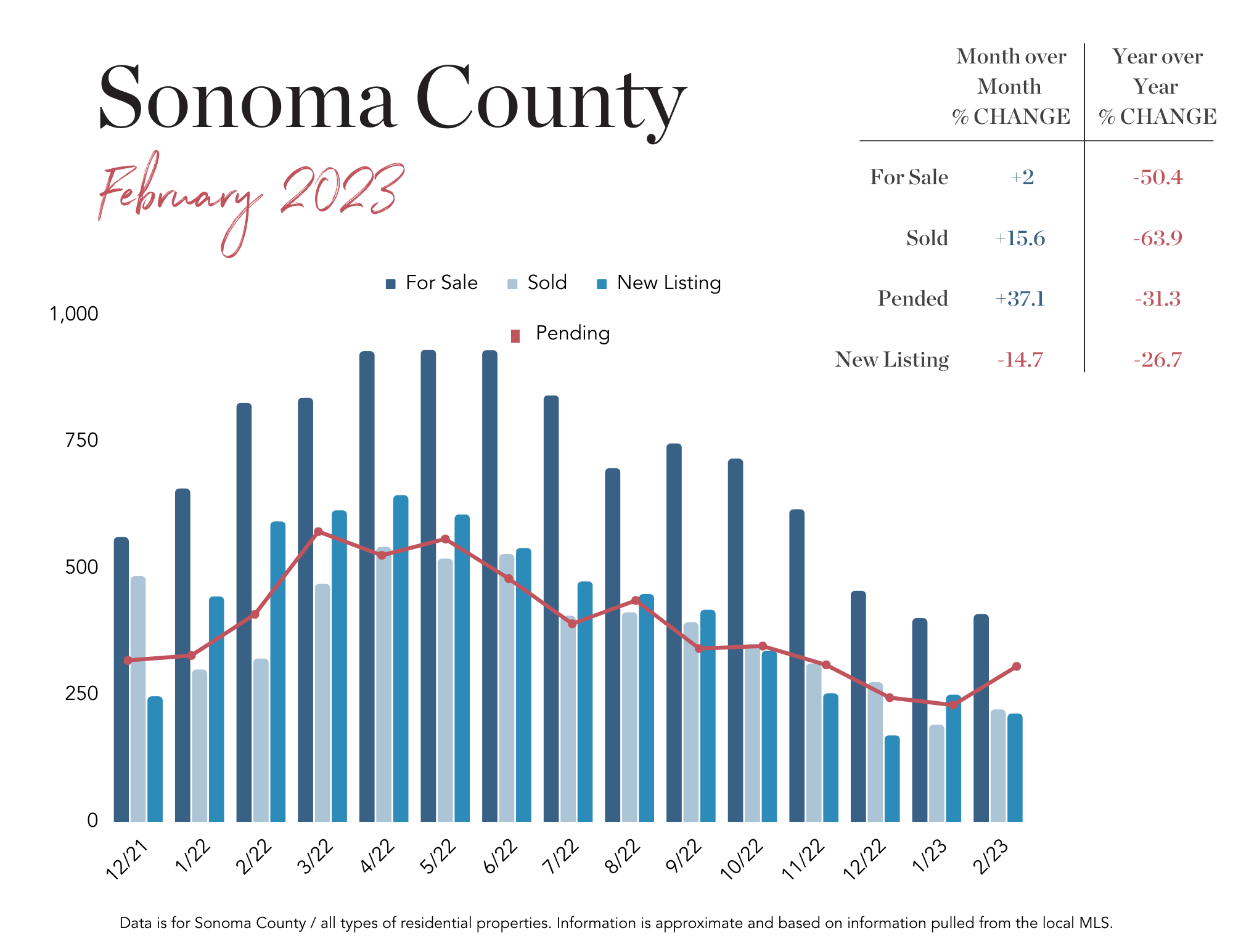

February 2023 Sonoma County Market Update

The spring housing market is heating up! With inventory in the North Bay down 50 percent year-over-year, we are continuing to see multiple offer situations and sales prices going over asking. While it’s usually not at the same rate or increase that we saw over the last few years, it does tell us that buyers have entered back into the market and sticker shock of the sharp rise in interest rates has settled a bit.

Sonoma County Spring Housing Market Predictions

One thing I love about this month, is the mustard, which pops up in our vineyards towards the end of winter. These beautiful blooms are a welcome sign that spring is right around the corner and with all the rain we are getting it is stunning!

Speaking of spring, the real estate market in Sonoma County is starting to heat up! Rising interest rates, combined with high homes prices led to a slow fall and winter season. A stark contrast from the hot market we had leading up to summer 2022.

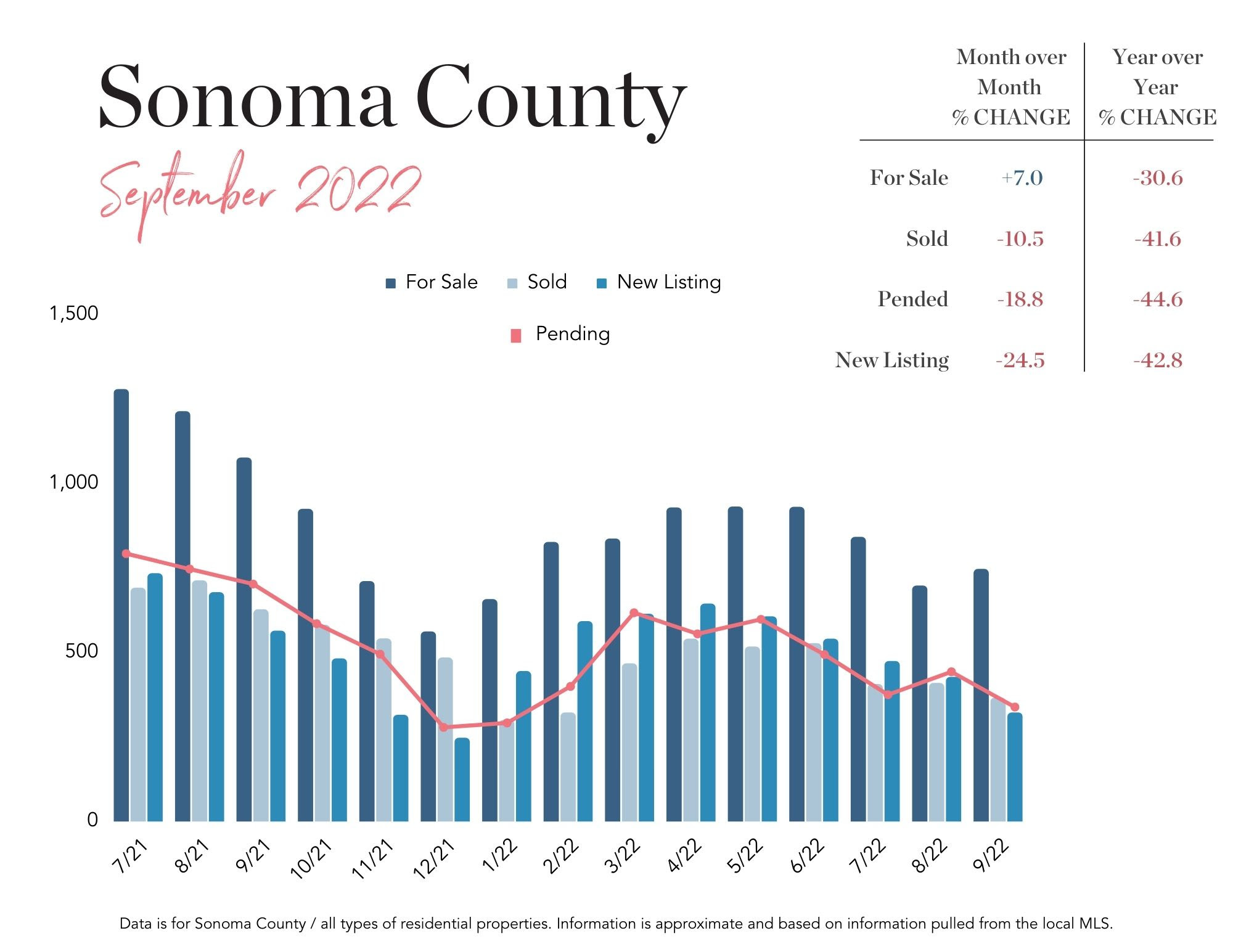

Sonoma County Real Estate Market Update: What Happened in September 2022

Market Talk It’s officially fall and inventory is on the rise around the country. View the full report here: September 2022 Sonoma County Market Update. We are seeing the typical seasonal bump in new listings in the Wine Country. However, rising interest rates affect some would-be sellers too. They are holding off putting their homes on the market since they would be doubling their interest rate when buying a replacement home unless they purchase cash of course. And, there are still plenty of buyers in the market place searching for homes! Mortgage interest rates are at their highest level in more than 14 years, sales inventory has ticked up a bit but is still historically low, and fear of a looming recession is still a topic of discussion in the media. What we do know is there are still buyers actively shopping for homes, and desirable properties that show well and are priced correctly have been going into contract, in some cases even with multiple offers and well over asking. One recent country property in Sebastopol priced at $2 million sold for $3,150,000! It’s very important that buyers understand there are a number of loan programs out there that can help offset the higher monthly payment at today’s rates, and rates can vary significantly from lender to lender. You want to make sure you shop around and look at all options, from 2-1 rate buy down programs to credit union rates and special institutional lending programs. Be diligent in your research before choosing a lender to work with. And a flashback to earlier years, some sellers may even have mortgages that are assumable at yesterday's low rates. In the past those were typically adjustable mortgages so again it is important to do careful research. Traditionally, markets like this will stabilize, but when that happens and what "stability" looks like is up in the air. Reach out to your trusted real estate professional to help you decide if it makes sense to make a move now or wait! ...

Pending Sales for July up to Highest Rate of 2012 while Homes Inventory Declines 39%

The rate of home sales in Sonoma County continues to rise, and inventory is dropping even faster. Here is a detailed set of market statistics for Sonoma County from July 2011 through July 2012....

Newly Pending Home Sales in Sonoma County up 65% Year over Year October 2011 vs. 2010

Home sales statistics can be an interesting way to understand the timing of a home sale or purchase in Sonoma County, but sometimes it helps to go back a few years to be able to discern trends. Pam Buda, DRE 01381495, takes a look at current market data from a few different angles....

Sonoma County Home Sales Resume Pace 2 Months after Tax Credit Expiration

A look at the latest real estate sales trends for Sonoma County, based on sales figures through July 2010. The market is somewhat stabilized, with a greater diversity of properties for sale from "regular" folks, and less of a reliance on distressed properties. Newly pending sales through July matched the high rate of sales from April 2010, when the federal tax credit was about to expire....

Sonoma County Real Estate Sales Update

Year over year the median Sonoma County home price dropped 5% to $359,000. However, the apparent bottom for this market (whether a V, U or W is yet to be determined) was in February when the median price was #315,000. Some of my smart buyer clients (you know who you are) are happily ensconced in homes they bought in January and February, sensing the (a?) bottom had arrived....

Median Home Price Rises in Sonoma County

A few days ago I wrote in a post: The sheer activity level, the vast number of first time buyers and investor clients looking for rental property, and the declining number of new listings have all been detailed here over the previous months. In December, new sales exceeded new listings for the first time in many months, and, beginning in February it seems to us that the bottom was reached and had passed some entry level buyers by. A few minutes ago I received the following snapshot of the Sonoma County Real Estate Market closed sales figures from March 2008 through March 2009, thanks to my broker, Rick Laws of Coldwell Banker, who compiles our market statistics and shares them generously, with not only me and my colleagues, but the Press Democrat newspaper. Obviously one of the take aways from this graph, year over year, is the 27% drop in median price for the county. But the median price rose from its low in February about $10,000 with a high rate of closed sales and a good statistical base. Prices on the low end seem to have stabilized and maybe bounced upwards a few percent. This is as welcome as the signs of spring!...

November 2008 Sonoma County Real Estate Sales still cooking

Given the short month, the holiday season and oh yes, the economic meltdown in the news, real estate sales are holding steady as viewed at the end of November, 2008 in Sonoma County California. I will have more detailed information by price points later in the month but here is a quick tidbit of post-Thanksgiving real estate stats. The number of units sold will increase with the final report since there is a several day lag on sales closed at the end of each month while the reporting catches up. This information is provided by Rick Laws, my broker at Coldwell Banker Santa Rosa, and is based upon sales reported via the MLS here by Brokermetrics.                                     Nov 07        Nov 08         #Units Change         Percent Change Under Contract         206              455                  249                     120.9 % Sold                               242             320                  78                        32.2 % New Listings                474              370                -104                    -21.9 % First thing that jumps out is that there were 120.9 % MORE brave souls who wrote offers on properties in this wild short month of November versus last year at this time. The number of closed sales is up at least 32 % year to year as well.  The number of new listings has declined nearly 22 % versus last November, as many people hunker down. This makes for some interesting trend lines year over year, as well as expected seasonal declines in units sold as we head into the winter months.  Anecdotally, the buyers are split about evenly between investors and first-time home buyers. Units sold are dominated by the low-end of our market, under $400,000. Since the one point drop in mortgage rates just before Thanksgiving really was not much of a factor in November's sales, it will be interesting to see how that boosts (or not) our real estate sales for Sonoma County in December.  Stay tuned....