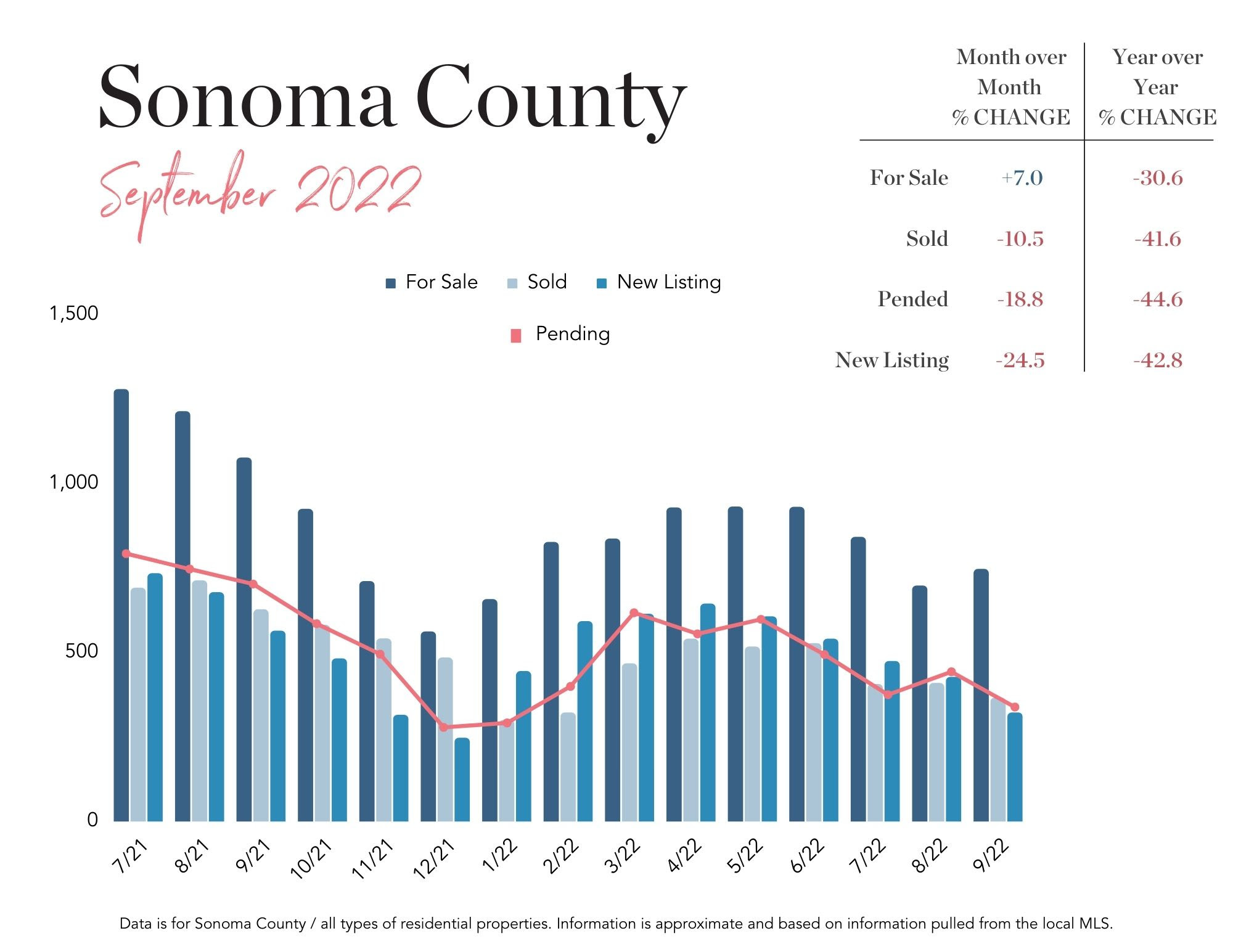

Sonoma County Real Estate Market Update: What Happened in September 2022

Market Talk It’s officially fall and inventory is on the rise around the country. View the full report here: September 2022 Sonoma County Market Update. We are seeing the typical seasonal bump in new listings in the Wine Country. However, rising interest rates affect some would-be sellers too. They are holding off putting their homes on the market since they would be doubling their interest rate when buying a replacement home unless they purchase cash of course. And, there are still plenty of buyers in the market place searching for homes! Mortgage interest rates are at their highest level in more than 14 years, sales inventory has ticked up a bit but is still historically low, and fear of a looming recession is still a topic of discussion in the media. What we do know is there are still buyers actively shopping for homes, and desirable properties that show well and are priced correctly have been going into contract, in some cases even with multiple offers and well over asking. One recent country property in Sebastopol priced at $2 million sold for $3,150,000! It’s very important that buyers understand there are a number of loan programs out there that can help offset the higher monthly payment at today’s rates, and rates can vary significantly from lender to lender. You want to make sure you shop around and look at all options, from 2-1 rate buy down programs to credit union rates and special institutional lending programs. Be diligent in your research before choosing a lender to work with. And a flashback to earlier years, some sellers may even have mortgages that are assumable at yesterday's low rates. In the past those were typically adjustable mortgages so again it is important to do careful research. Traditionally, markets like this will stabilize, but when that happens and what "stability" looks like is up in the air. Reach out to your trusted real estate professional to help you decide if it makes sense to make a move now or wait! ...

2022 Sonoma County Summer Housing Market Update ?

Do you have questions about Sonoma County's housing market? As quickly as mortgage rates are rising, the once red-hot market is showing signs of cooling. Home prices are still historically high, but there is some concern (fueled by the media) that they will ease up as well. Today I want to run through some of the latest trends we've been seeing this summer and discuss what they say about the state of our market. For a more detailed overview, be sure to check out the Corcoran Q2 2022 Real Estate Report. First let's address a question I have been getting a lot lately: Is today’s housing market in the same predicament that it was over a decade ago, when the 2007-08 crash caused the Great Recession? The short answer is: no. America’s housing market is in far better health today. That’s thanks, in part, to new lending regulations that resulted from that meltdown. Those rules put today’s borrowers on far firmer footing. But what about rising interest rates? During the pandemic, rates were historically low, but that’s starting to change. For most of July, my clients received interest rates in the 5.5% range. While that seems high, it’s not too far off from where rates were before the pandemic. Why a slight slowdown in our market might actually be a good thing...

Sonoma County Market Update | Q4 2021

Sonoma County Market Update: It's our pleasure to bring you the Corcoran 2021 Q4 Real Estate Market Report. Flip through this album depicting real estate sales stats town by town and county wide! Even though we're well on our way to a busy market in 2022, it's important to pause and reflect on how the last quarter provides context for the housing market trends we see today in Sonoma County. Here is a quick recap. Sales activity remained steadfast in Q4. Sales did slow down a bit over the holidays, which is a typical seasonal pattern. The median home price reached $769,000, which was a 9.9% year-over-year increase. Overall, we ended 2021 with solid growth (exceeding predictions) for Sonoma County real estate and the promise of another fruitful year ahead. Some of the hottest local markets right now include: Sebastopol (29.9% median price increase!), Sonoma & Healdsburg! Throughout the county home prices saw significant price appreciation although unit sales were down when compared to 2020. Sonoma County Market Update | Q4 Market Highlights: >>>VIEW THE FULL MARKET REPORT<<< Home prices continued to trend upward in most Sonoma County communities as inventory constraints remain. For example, year-over-year prices in Sonoma exponentially increased in the fourth quarter to a median sales price of $1.2 million (+42.4% increase year over year). Sebastopol and Sonoma were tied for the highest median sales price in the county at $1.2 million. What To Expect This Year...

2022 National Real Estate Predictions (Our Sonoma County Results May Vary!)

2022 Real Estate Predictions: The real estate market in 2021 saw unprecedented highs here in Sonoma County. We enjoyed a golden year of home price appreciation, low interest rates and limited inventory. Creating the perfect storm for sellers to cash in on all the equity gained! With mortgage rates expecting to increase and many federal support and relief programs set to end in the new year, we are predicting the market will look a bit different by the end of 2022. Here’s what the future holds for real estate in 2022. According to Dr. Lawrence Yun, Chief Economist at the National Association of REALTORS® and industry leader, Brian Buffini, who’s renowned for his historically accurate market predictions. If you would like to see their video presentation from December, the link is here. Important: These trends focus on the market at the national level and trickle down to impact us locally. For a more in-depth dive on Sonoma County's local housing market stats. Visit our blog: Sonoma County Market Update | Q4 2021 1. Multiple Offers Still a Thing, But Not as Hectic Looking at the real estate’s performance heading into 2022, Yun stated that the multiple-offer frenzy that took hold in the spring of 2021 had died down with homes on the market a bit longer than before—but they are still selling fast. “People rushed to buy homes during the pandemic,” Yun said, pointing to a 7% increase in home sales from 2020 to 2021—from 5.7 million to 6 million, respectively. Yun predicted, however, that there will be a 2% reduction in sales this year as mortgage rates increase. Buffini predicted that by the summer of 2022, there will be less over the top offers as first time homebuyers will be pushed to their max with increased mortgage rates and higher inflation. 2. More Inventory in Spring 2022 The housing shortage in conjunction with high buyer demand increased competition throughout 2020 and 2021, though new construction of single-family homes has been increasing, and it is predicted that there will be more inventory in the spring of 2022 as compared to last year. Yun also indicated that more people are likely to list their homes now that federal support and mortgage forbearance programs are either ended or are slated to end this year. 3. Mortgage Rates Will Tick Up to Nearly 4% by the End of 2022 Mortgage rates are predicted to climb to 3.7% by the end of 2022, affecting first-time homebuyers...

Sonoma County Real Estate Closing 2021 Strong!?

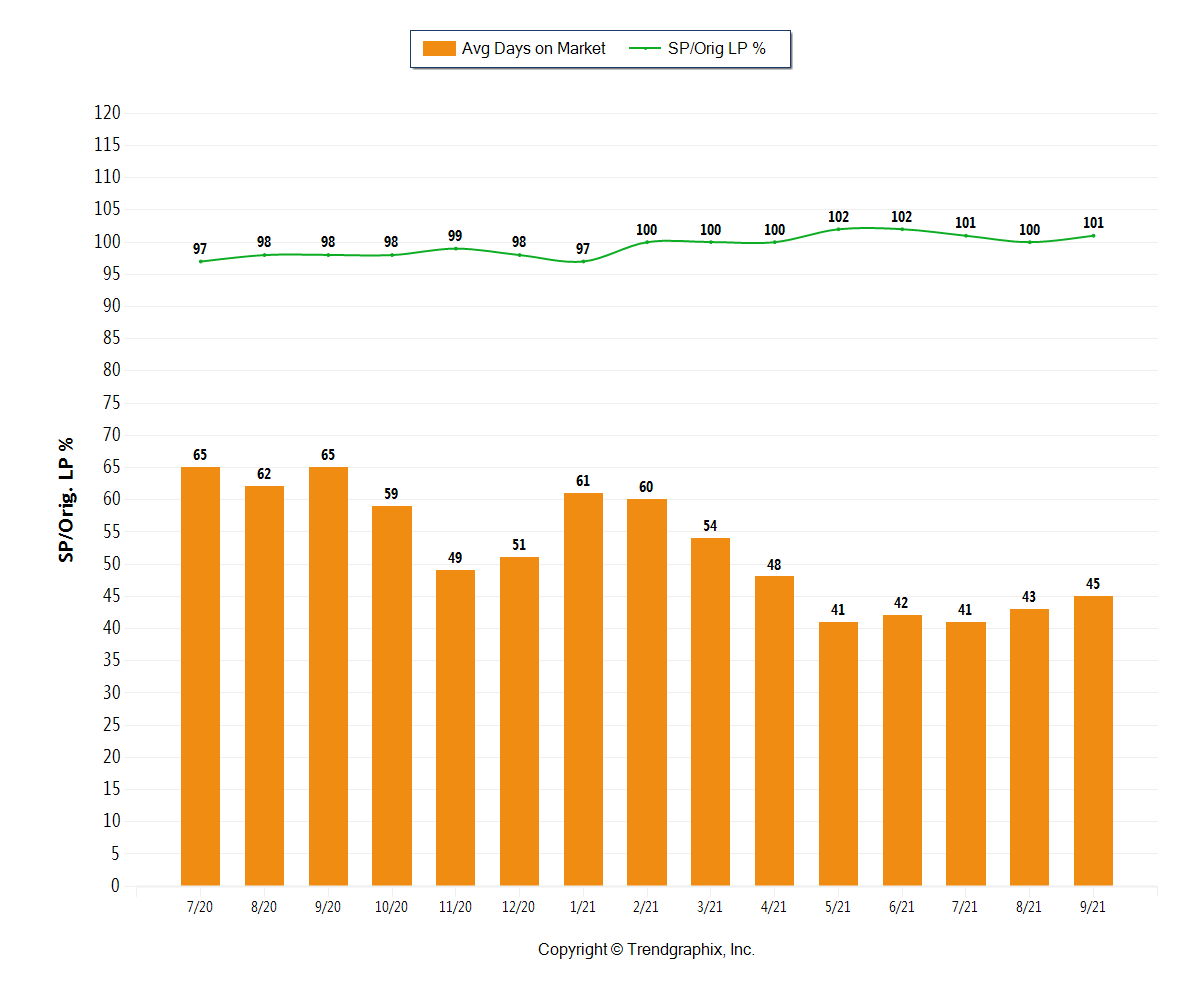

It's our pleasure to bring you the Corcoran 2021 Q3 Real Estate Market Report. As we approach the end of a historic year for SonomaCounty real estate, 2021 sales activity remains steadfast. Home sales saw an increase by 4.5% since 2020’s third quarter and communities throughout Sonoma County continue to boast strong housing market sales. Watch the video below for a quick recap on what's happening in our local real estate market. The big news for Q3 is our market has fallen back into a more predictable seasonal pattern. We experienced a slight dip in the late summer months, due to vacation plans, and since Labor Day sales have picked back up debunking the myth that we may be headed for a market crash. By the end of September home sales were up 4.5% year-over-year and days on market fell 33.3% to 42 days. Additionally, homes sold for 101% of their asking price and inventory remained low at 1.2 months. What To Expect This Winter...

Leaves Are Falling ? But Home Prices Are Not! ??

Market Update: Is Sonoma County Real Estate Cooling? There's been a lot of buzz about a possible market slowdown in Sonoma County. To clear the air, below we've taken a closer look at the numbers over the past quarter to provide both clarity and insight into how we'll likely end the year. Here's what we found...

Are we in a Housing Bubble in Sonoma County?

I cannot count the exact number of times I have been asked if we are in a housing bubble in Sonoma County. Every agent I know all over the US has also been asked the same question--it is no wonder, as prices seem to be climbing ever upwards and we all (or most of us) remember what happened in 2008-2010! What is so different about today? The Great Recession was driven by excess and abuses in the housing and mortgage markets. This national boom in real estate has been fueled by people reevaluating their circumstances due to Covid and sustained by record low interest rates and a shortage of housing. Brian Buffini and Company produced this solid infographic explaining the differences and root causes in both markets. ...

Are we in a housing bubble in Sonoma County?

Sonoma County’s vibrant housing market became even hotter through the first three months of 2021 as a rush of Bay Area residents continued to flee dense urban areas for the Wine Country, sending the county’s median home price to an all-time high at the end of Q1! Watch the video above for a quick recap on what's happening in our local real estate market. Untethered from the office, many house hunters sought bigger living spaces and a more relaxed lifestyle. North Bay home prices that are viewed as a bargain compared to many other parts of the Bay Area were also a draw. And historic low interest rates spurred homebuyers to take advantage of attractive mortgage terms. The median price for a home in Sonoma County has increased 13% since March 2020, when the lockdown began. Over the first three months of 2021, the median price was $745,000, a 15% bump from the same period in 2020. During first quarter of 2021, 1,049 home sales were finalized, a nearly 30% spike compared to the previous year. These figures represent a remarkable turnaround for a local housing market that basically shut down for a couple of months last spring. *Note: These stats reflect single family homes in Sonoma County and do not include condominiums. Are we in a housing bubble? Today, most home loans are 30-year fixed-rate mortgages with historic low interest rates. Thanks to lending reform, people don't get approved for a loan they can't pay like they did in the 2000s when the market crashed. This means that even though houses are selling for top dollar, the buyers that purchase them can afford it. The amount of cash (often from stock rich tech workers) we have in the market continues to impact multiple offer scenarios—and while we can't predict what will happen in the coming months, all we can say is that this market looks nothing like it did back when the bubble burst in 2008. There is a national shortage of housing stock that is a trailing effect of the great recession. So, we think it's safe to say that we are NOT in a housing bubble. What To Expect As We Look Ahead to Summer 2021...

HOT Sonoma County Housing Market ?

Sonoma County’s vibrant housing market turned red-hot through the first three months of 2021 as a rush of Bay Area residents continued to flee dense urban areas for Wine Country during the pandemic, sending the county’s median home price to an all-time high in March. The median price for a home in Sonoma County has increased 13% since March 2020, when the pandemic had begun and started to affect the county housing market. Over the first three months of 2021, the median price was $745,000, a 15% bump from the same period in 2020. In March, 421 area homes were sold, an increase of 39% from the same month last year. During first quarter of 2021, 1,049 home sales were finalized, a nearly 30% spike compared to the previous year. Click here to see the Press Democrat's article on April 14th about the market turning "red-hot": Sonoma County's Hot Market Hits Price Record in March....

Sonoma County Housing Market Breaks Records in 2020!

After the coronavirus pandemic sent Sonoma County homebuying into a tailspin last spring, the local housing market rebounded to have a banner year, posting a record annual median home price and the most houses and condos sold in seven years! As we embark on a new year (we can’t believe it’s already February), let’s take a look at some of the important real estate highlights from 2020 and what experts are forecasting for the spring season. [caption id="attachment_21108" align="aligncenter" width="408"] *Note: The median price for single family homes in Sonoma County is $700,000, slightly higher than $675,000 mentioned in this report which includes condominiums.[/caption] What This Means For Buyers & Sellers: Low inventory, high buyer demand and increasing home prices have resulted in a seller’s market as we enter 2021. Historic low interest rates are drawing more buyers, especially millennials, into the marketplace. Buyers are flocking to Sonoma County from the Bay Area due to changing household needs and work-from-home flexibility. Despite home prices increasing, Sonoma County is still considered an affordable option compared to the Bay Area with a median single family home price of $700,000 vs $1.06 million. What To Expect As We Look Ahead to Spring 2021...