🍁 Homes, Architecture & Autumn in Sonoma County

As we move into fall, California’s real estate market is holding steady.

While there are fewer new listings and sales, overall inventory has grown and prices have stayed stable, giving buyers more choices and sellers a chance to shine. Homes are spending a bit more time on the market, which can be a good thing for both buyers and sellers to make thoughtful decisions.

🍇 The Surprising Top Spot For Boomer Wealth (Outside Florida)

As we soak up the last days of summer, the real estate market across much of California is still humming along.

While some seasons bring a slowdown, current trends show steady activity, from pricing to pace. Whether you’re just keeping an eye on things or starting to think ahead, it’s a great time to stay tuned in and see where our local Sonoma County market is heading next.

The lesson is clear: those who adapt will thrive ✨

While summer often brings a slower rhythm to everyday life, the real estate market doesn’t always hit pause—especially here in Sonoma County. This summer buyer and seller activity appear to have picked up as the year progresses.

In fact, summer can be a smart time to make a move, with motivated buyers and sellers taking advantage of changing inventory levels, favorable weather for home showings, and a desire to get settled before the school year or holiday season begins.

Now is the perfect time to take a fresh look at what’s happening in the Sonoma County market.

Did the Real Estate Market Fizzle in May? 🏡

As summer kicks in people have started planning getaways, celebrations, renovations and for real estate transactions.

In Sonoma County for the first time in several years we have had a pretty typical spring season. There is definitely more inventory on the market than we have had in years, so that is great for buyers.

For sellers, luckily our local market has performed much better over the past month than in other parts of the country where sales have slowed more significantly. 40% of transactions had multiple offers last month.

Even with mortgage rates still dancing around 7%, many seem to view this as a new “normal” and manageable.

📈 Rising Inventory—Is the Market Shifting in Sonoma County?

“The earth laughs in flowers.” – Ralph Waldo Emerson

Sonoma County is blooming—both in landscape and in market activity.

As spring hits its stride, the real estate market is showing signs of seasonal momentum. Sellers are stepping forward, buyers are reengaging, and the rhythm of spring activity is taking shape across the county.

📊 Sonoma County Market Update: Key Housing Trends

“April prepares her green traffic light and the world thinks Go.” – Christopher Morley

Spring has officially sprung in Sonoma County!

The days are longer, the hills are greener, and the real estate market is beginning to wake up from its winter nap.

While some buyers are still navigating affordability and rate adjustments, many are re-entering the market with fresh energy—and more inventory means more opportunity all around.

🌿 Spring in Sonoma County: Local Events, Market Insights & Tax Tips!

Spring is just around the corner here in beautiful Sonoma County, and with it comes fresh opportunities, vibrant local events, and a renewed focus on our homes.

As we move into 2025, Sonoma County’s real estate market reflects a changing landscape, with year-over-year shifts in pricing, inventory, and buyer activity shaping the market.

As your resource for all things Sonoma County real estate—from horse and country property to homes and condos in town—I’m excited to share the latest market updates, emerging trends, and helpful financial tips.

📊 New Year Real Estate Highlights & Wildfire Relief

Welcome to a new year! I must confess I’ve been a bit slow to embrace 2025, hence the late timing of this email. With everything going on, it seemed appropriate to allow some time for rest and reflection before jumping in.

How are things in your world?

In regards to Sonoma County real estate, so far it’s been a slow start. The typical holiday slowdown seemed to linger a bit longer, but market activity is starting to pick up. I am interested to see what trends are revealed when we get the January stats next month.

🎄 Holiday Fun + Changes to the Sonoma County Market

“Times, they are a-changin’.” – Bob Dylan

This sentiment rings true as we navigate the twists and turns of Sonoma County’s real estate market. November’s data paints a picture of both opportunities and challenges, prompting buyers and sellers alike to reassess their strategies heading into the new year.

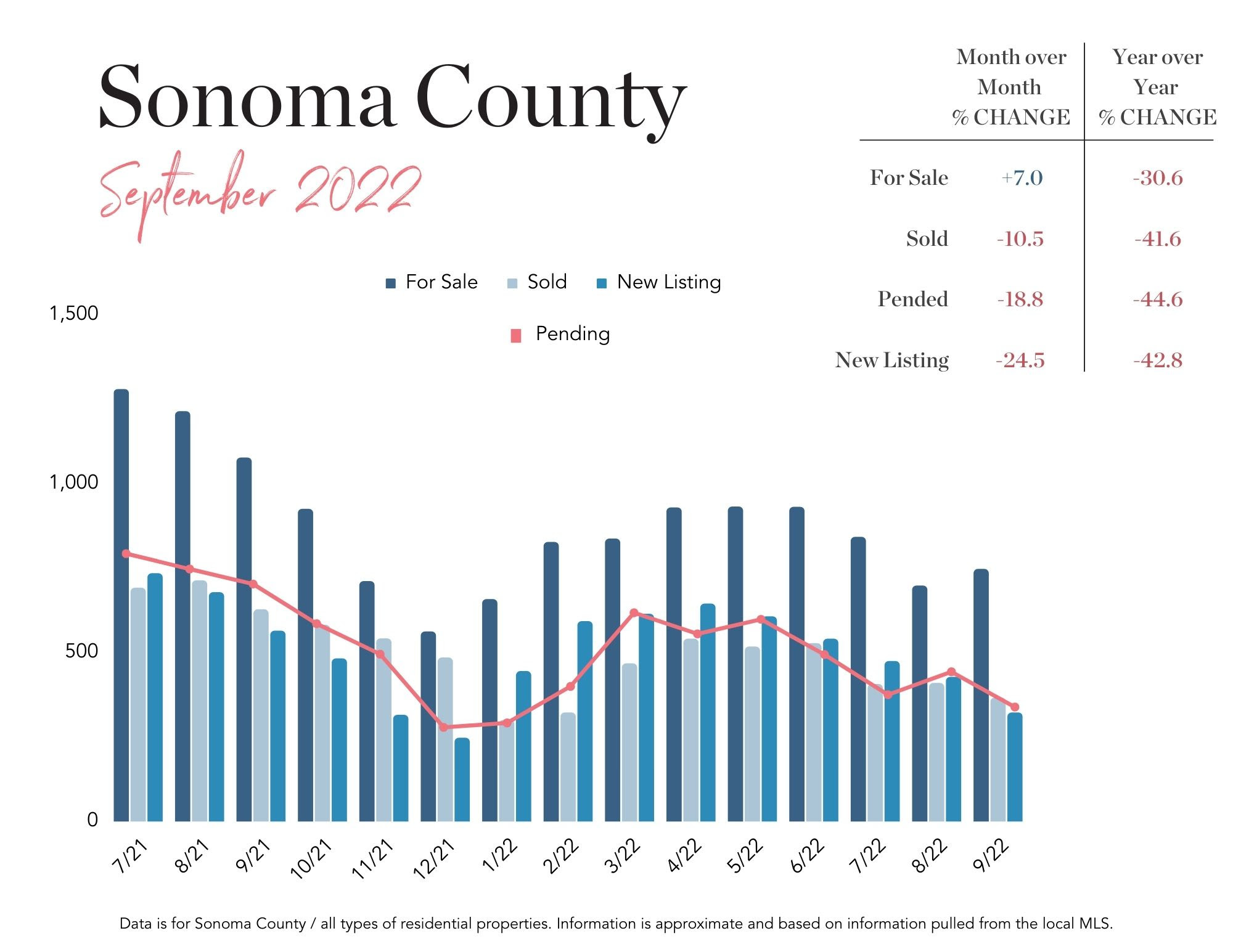

Sonoma County Real Estate Market Update: What Happened in September 2022

Market Talk It’s officially fall and inventory is on the rise around the country. View the full report here: September 2022 Sonoma County Market Update. We are seeing the typical seasonal bump in new listings in the Wine Country. However, rising interest rates affect some would-be sellers too. They are holding off putting their homes on the market since they would be doubling their interest rate when buying a replacement home unless they purchase cash of course. And, there are still plenty of buyers in the market place searching for homes! Mortgage interest rates are at their highest level in more than 14 years, sales inventory has ticked up a bit but is still historically low, and fear of a looming recession is still a topic of discussion in the media. What we do know is there are still buyers actively shopping for homes, and desirable properties that show well and are priced correctly have been going into contract, in some cases even with multiple offers and well over asking. One recent country property in Sebastopol priced at $2 million sold for $3,150,000! It’s very important that buyers understand there are a number of loan programs out there that can help offset the higher monthly payment at today’s rates, and rates can vary significantly from lender to lender. You want to make sure you shop around and look at all options, from 2-1 rate buy down programs to credit union rates and special institutional lending programs. Be diligent in your research before choosing a lender to work with. And a flashback to earlier years, some sellers may even have mortgages that are assumable at yesterday's low rates. In the past those were typically adjustable mortgages so again it is important to do careful research. Traditionally, markets like this will stabilize, but when that happens and what "stability" looks like is up in the air. Reach out to your trusted real estate professional to help you decide if it makes sense to make a move now or wait! ...